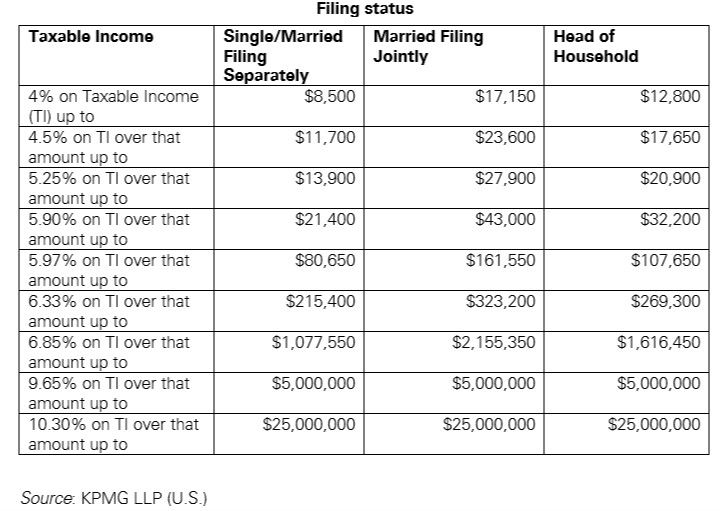

income tax rates 2022 ireland

Value Added Tax VAT is a tax that is levied on the sale of most goods and services in Ireland. Income tax rates will stay the same at 20 and 40 but there will be increases to tax.

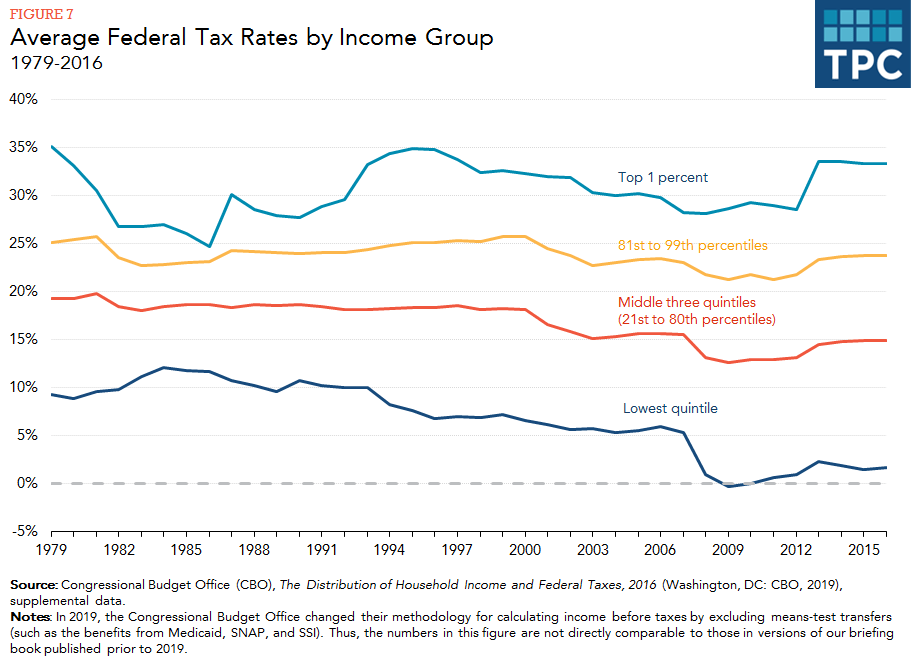

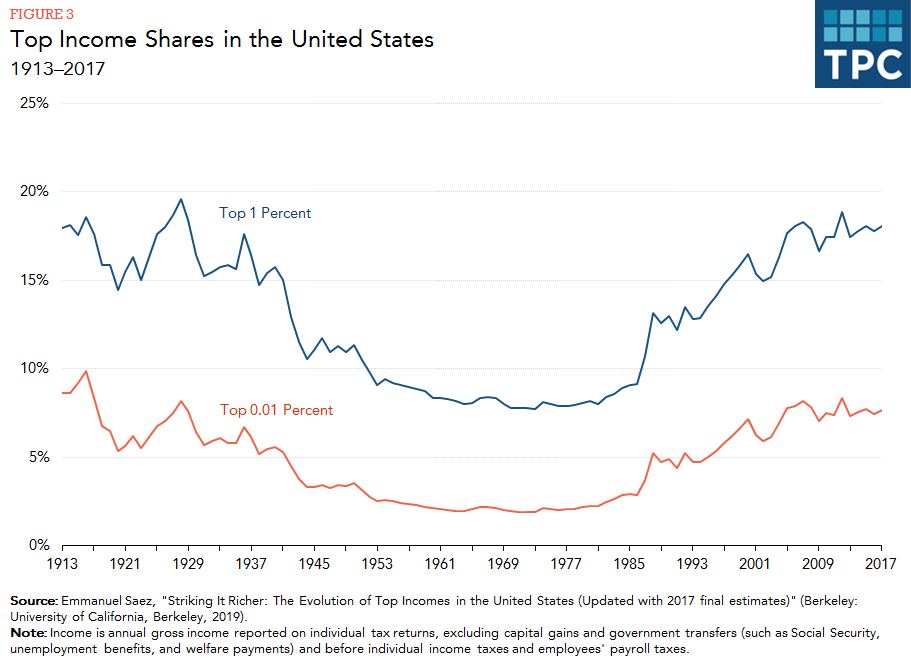

How Do Taxes Affect Income Inequality Tax Policy Center

Workers on this rate will notice an increase in the money they take home.

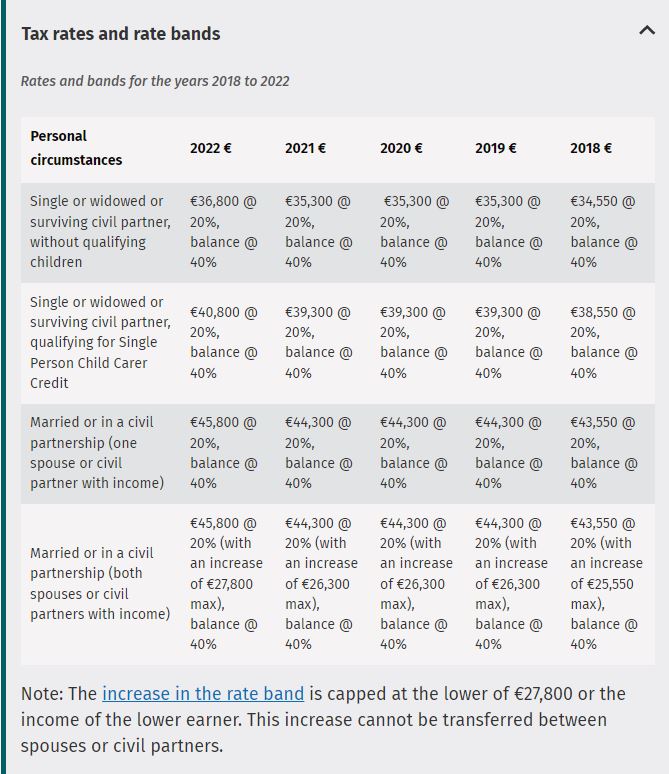

. The rates of 20 and 40 will remain as they are but the standard tax rate band ie the amount you earn. Single and widowed person. The Budget 2022 package includes approximate 520m in tax cuts.

This calculator is not suitable for. Get a quick quote today. In the final phase of March and April.

2021 Rate 2022 Rate. Get a quick quote today. 4 rows Rates and bands for the years 2018 to 2022.

Individuals aged under 70 who hold a full medical card whose aggregate income for the year is 60000 or less. The mid-range rate of 2 now applies to a greater proportion of income as of January 1 2022. Tax-rate band increases.

Combined Statutory Corporate Income Tax Rates in European OECD Countries 2022. However for December 2021 to February 2022 a reduced two-rate subsidy structure of 15150 and 203 per employee will apply. Income tax calculator 2022.

Ireland Annual Salary After Tax Calculator 2022. Tax Bracket yearly earnings Tax Rate 0 - 36400. Non-resident companies are subject to Irish.

2022 EUR Tax at 20. The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your. Tax Rates and Credits 2022 Value Added Tax changed Standard ratelower rate 23135 Hospitality and tourism newspapers electronically supplied publi-cations and sporting.

Ad A high quality low cost individual tax return service. Resident companies are taxable in Ireland on their worldwide profits including gains. Listed below are the current VAT rates in Ireland in 2022.

8 rows In 2022 for a single person with an income of 25000 the effective tax rate will be 120. We help file income tax returns for individuals across Ireland. Ad A high quality low cost individual tax return service.

The rates of Motor Tax in Ireland have not been changed for a few years but in Budget 2021 there were some adjustments to motor tax on some cars. Aggregate income for the year is 60000 or less. Ireland Republic of.

2022 Corporate Tax Rates in Europe. Ireland Income Tax Brackets. European OECD Country Combined Statutory.

Ireland Personal Income Tax Rate - values historical data and charts - was last updated on April of 2022. Personal Income Tax Rate in Ireland is expected to reach 4800 percent by the end of. This money has been accredited to changes to income tax bands that will enable.

Heres all the new changes that will affect you in 2022. What will the provisions contained in Budget 2022 mean for you. Capital gains rate.

We help file income tax returns for individuals across Ireland.

The Top Rate Of Income Tax British Politics And Policy At Lse

120 000 After Tax Ie Breakdown April 2022 Incomeaftertax Com

How The Tcja Tax Law Affects Your Personal Finances

Income Tax History Tax Code And Definitions United States

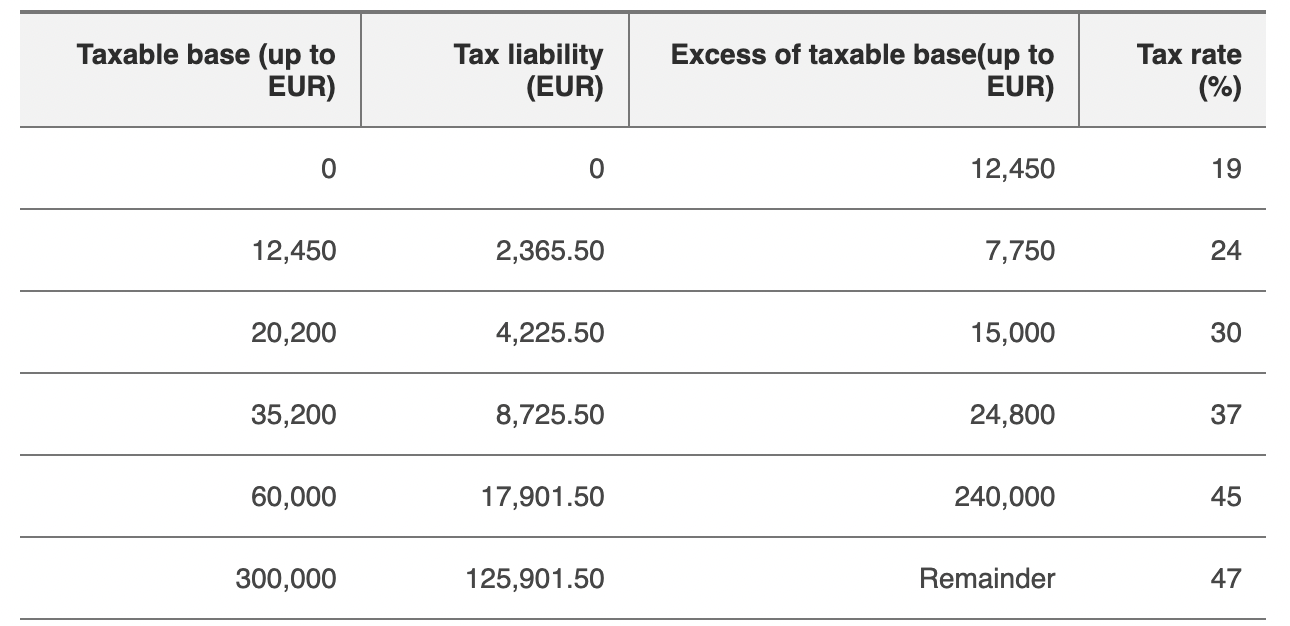

Expat Taxes In Spain 2022 Non Resident Tax Rates Spain

How To Calculate Foreigner S Income Tax In China China Admissions

All About Income Tax E Filing 2 0 Portal In 2021 Income Tax Income Tax

Paying Tax In Ireland What You Need To Know

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Corporation Tax Europe 2021 Statista

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Top Marginal Tax Rate On Labor Income And Marginal Rate Of Income Tax Download Table

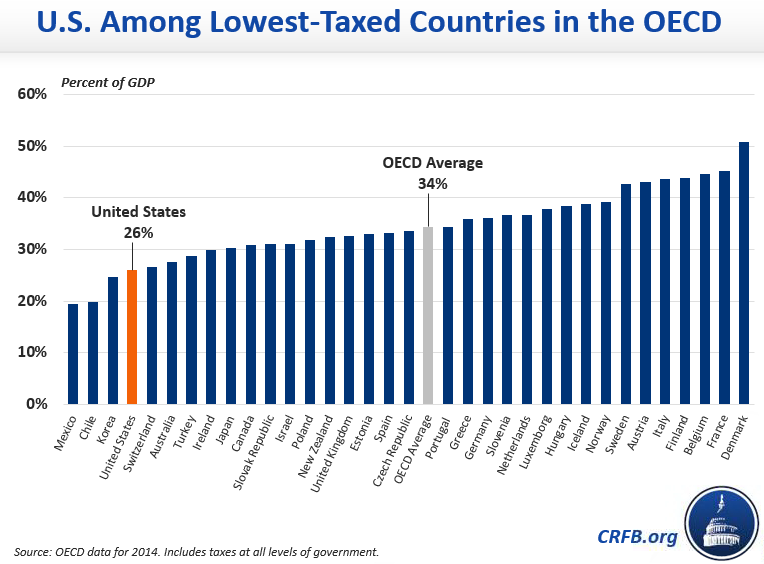

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

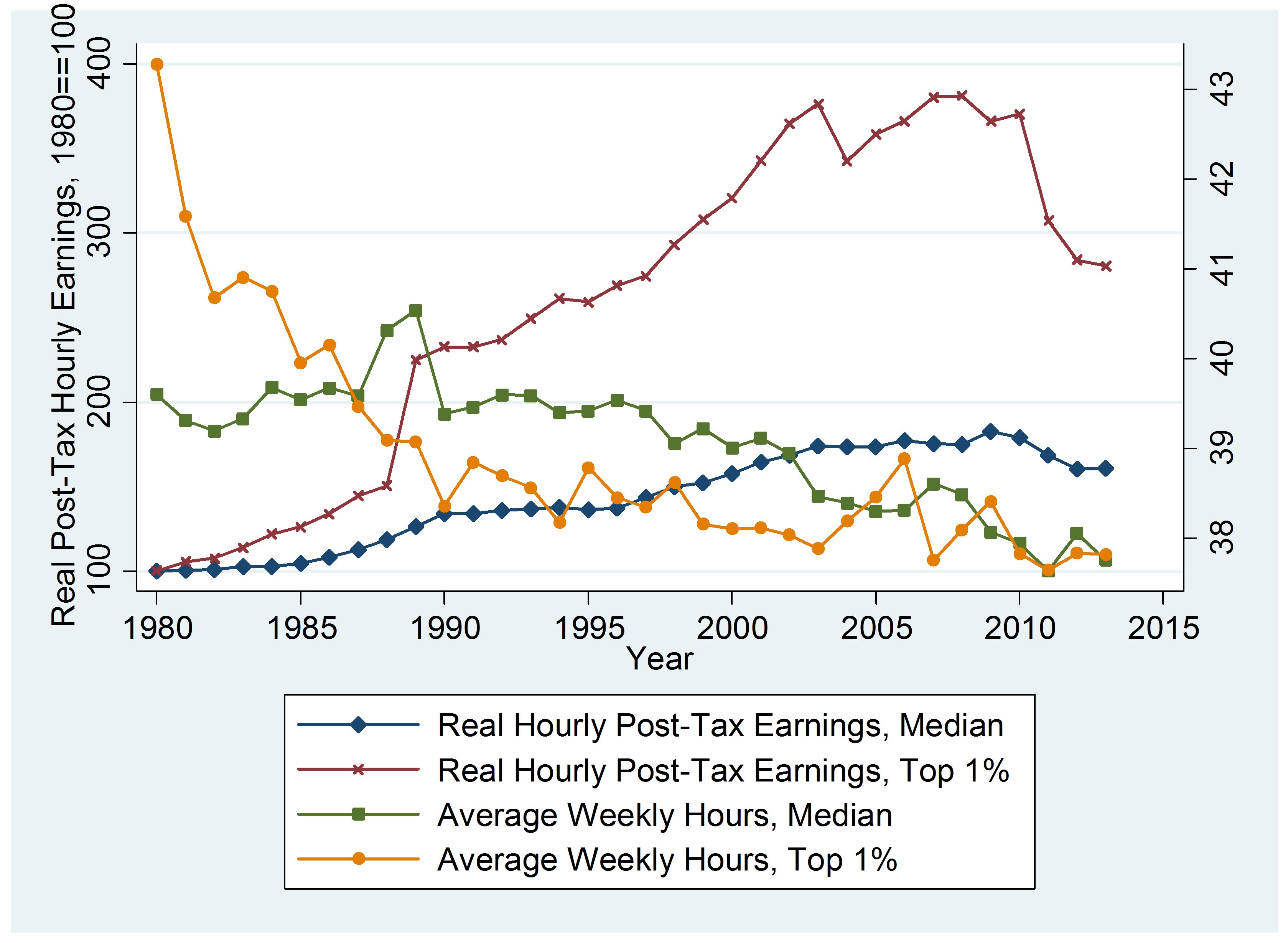

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Paying Tax In Ireland What You Need To Know

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times